After numerous theories and speculations regarding Kate Middleton’s health and a recent photo of her taken by TMZ, she and William shared a photo of the Princess and her three children on Mother’s Day.

Judging from the photo, Kate is indeed doing well after her surgery in January.

She poses on the patio with Prince George, Princess Charlotte, and Prince Louis surround her. They are all smiling and look absolutely adorable.

“Thank you for your kind wishes and continued support over the last two months. Wishing everyone a Happy Mother’s Day,” the caption on the Prince and Princess of Wales’ official Instagram account read. It was signed “C,” meaning Kate herself had written it.

https://www.instagram.com/p/C4U_IqTNaqU/embed/captioned/?cr=1&v=14&wp=540&rd=https%3A%2F%2Fboreddaddy.com&rp=%2Fhidden-signs-in-kate-middleton-picture-expose-bizarre-editing%2F%3Ffbclid%3DIwAR1xlAcdN5Yf1eYWTYcte01FnsuklvQPkW5WTkT1-T0Da11ApCmc7_Nn3ak#%7B%22ci%22%3A0%2C%22os%22%3A2722.5%2C%22ls%22%3A880.2999999998137%2C%22le%22%3A2712.7000000001863%7D

As expected, the photo was shared worldwide and was picked up but every single media outlet out there.

The comments under the photo came pouring in with a great number of people wishing Kate a speedy recovery.

According to some royal experts, Kate opted to post a photo in order to put a stop to the speculations surrounding her surgery and her recovery.

“They [Kensington Palace] are trying to send a clear message to both the public and the press to respect Kate’s privacy on this medical matter,” royal historian Kate Williams said. “What they’re trying to say is Kate is recovering, she’s fine, no more worries, no more panic, no more speculation.”

She added: “I think the last thing they [Kensington Palace] want is for her to feel she can’t go out and walk in case she’s going to be photographed.”

Shortly after the photo of the happy family was released, some started questioning its authenticity because as they claimed, the photo was obviously edited.

“Professional photographer here. Look closely at Princess Charlotte’s wrist. This is what happens when you composite layers in Photoshop. I’m not speculating on why the photo was edited like this, but it’s weird,” portrait photographer Martin Bamford wrote on X.

Some edit fails, as noticed by experts, were Princess Charlotte’s missing sleeve and blurred skirt and Kate’s misplaced zip.

Others noticed that Kate wasn’t wearing her ring and her hand around Louis was “blurry.” Her wrist and jumper sleeve were also manipulated by photoshop according to many, as well as her chin.

“The more you look at this, the worse it gets. the hands, the fact some parts are so blurry and some so sharp, the way Charlotte is apparently balancing in that position, there is literally a crease in the step, the reflection in the window doesn’t match,” one user wrote on X.

“Not really kept up with this whole conspiracy theory, but this photo is SOO DODGY two of their hands look very weird as if they’re AI generated, and the girls arm has 100% been photoshopped and her skirt also looks weird as f— as well?” another user added, continuing, “but if it’s a real photo – *why* would they edit it so much and so badly? they’re not stupid they would’ve seen all the rumours going about, releasing an awfully edited photo only fuels them.”

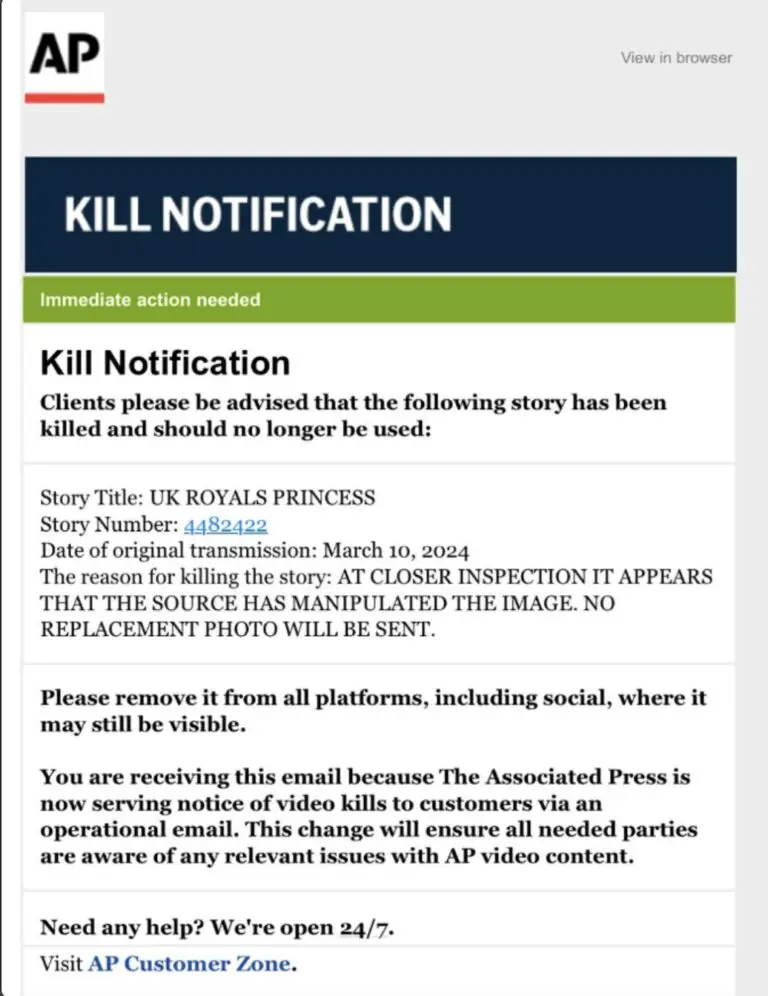

Shortly after, The Associated Press, Reuters, Getty Images, and Agence France-Presse all decided to issue “kill notices,” which are advisory notices to remove or not use a specific photo.

“It appears that the source has manipulated the image,” the Associated Press notification read.

They also released a statement, saying, “The Associated Press initially published the photo, which was issued by Kensington Palace. The AP later retracted the image because at closer inspection, it appears that the source had manipulated the image in a way that did not meet AP’s photo standards. The photo shows an inconsistency in the alignment of Princess Charlotte’s left hand.”

Speaking to GB News, Dr Hany Farid, a professor of computer sciences, said the work on Princess Charlotte’s sleeve looked like a “bad Photoshop job.”

“I clearly see what is being referenced here, with respect to her sleeve. It looks like a bad Photoshop job. I know we talk a lot about AI lately but it is still possible to use traditional photo-editing tools,” Farid said. “What you would be worried about here is if Kate wasn’t in this photo and had been digitally inserted. This would be a dramatic manipulation.”

On top of that, Kate not wearing ring fueled the rumors that something isn’t right between her and William.

Kate’s office decided to respond to the rumors by issuing a statement in which they explain that the reason why the Princess doesn’t have the ring on her finger is that she’s at home. They further added that it was William himself who took the photo.

Although the Palace didn’t comment on the edited photo, Kate herself decided to explain why the image had “flaws.”

On her and William’s official X account, she wrote, “Like many amateur photographers, I do occasionally experiment with editing. I wanted to express my apologies for any confusion the family photograph we shared yesterday caused. I hope everyone celebrating had a very happy Mother’s Day. C.”

Kensington Palace has later confirmed it “would not be reissuing the original unedited photograph of Kate and her children.”

According to royal expert Katie Nicholl, the Palace would be under much pressure following the issue with the photo.

“What’s so major in all of this is that four international picture agencies have killed this image. That’s really rare,” Nicholl said.

“I can’t think of a a time since I’ve been doing this job for the best part of 15 years where a royal image has been recalled. So that’s highly unusual. It might force Kensington Palace’s hand.”

On top of the pressure she faces, Kate now has to deal with another “problem” that’s giving her headaches, her uncle’s participation in the reality show Celebrity Big Brother. Since entering the house, he spoke of his niece on several occasions and opened up about Harry and Meghan, too.

“Clearly, whatever’s happened to Catherine, she’s probably feeling fragile – mentally as well. To have a serious setback like this at the prime of your life, it must knock your confidence, and so she’ll be fragile at this stage in her recovery and to have this thrown at her. She must just be thinking, ‘Why, why, why did Uncle Gary have to do this? ‘I imagine she’s thoroughly depressed about it,” royal expert Jennie Bond told the Mirror.

“I think that Gary comes from a good place in his heart. If he talks about her it’s – in his view – to give her side of the story, give her a mouth, a voice, when he knows she can’t off the back of allegations made of her,” Bond added.

“But I think it’s the last thing she’d want – if Catherine or William want to say anything, they will say it. They don’t need anyone else to, least of all someone within their own family – and they don’t have that strong connection anyway.”

DOLLY PARTON’S SECRET LIFE: INSIDE HER COZY FARM WITH HUSBAND OF 57 YEARS

Dolly Parton, with a net worth of $500 million, and her husband Carl Dean, who prefers to stay out of the spotlight, live a peaceful life on a cozy farm. Instead of indulging in lavish luxuries, they choose a quiet and simple lifestyle away from the hustle and bustle.

In an interview with Entertainment Tonight, Dolly shared that keeping Carl out of the spotlight is a key reason their relationship has endured for so many years. They’ve remained close and content, enjoying their time together on their charming farm.

Dolly Parton says that her husband, Carl Dean, chose her, not her career, and she respects his wish for a quiet life away from the spotlight. Even though people often wonder about Dean because he rarely appears in public, Parton explains that he prefers staying out of the limelight to maintain his peace.

Their relationship is built on mutual respect. Parton values that Dean isn’t jealous of her success and is genuinely interested in her work. His encouragement has been important to her, and they make a great pair.

Dolly and Carl live a peaceful life on their farm. Dean has retired from his paving business, and they enjoy spending time together doing simple things. They go on RV trips, explore Tennessee and Kentucky, and stay at clean motels during their travels. Parton loves these moments, especially after finishing her music tours.

Despite her significant wealth, Parton focuses on enjoying her time with Dean. For their 55th wedding anniversary, they had a modest country dinner at home with a meal prepared by Parton, including chicken and dumplings and Dean’s favorite, pecan ice cream.

Parton also showed off their beautiful home in a YouTube series hosted by Reese Witherspoon. Though they had planned to renew their vows for their 50th anniversary, they celebrated with a simple country dinner instead.

While Parton still performs occasionally, she knows this will slow down as she gets older. For now, she treasures her quiet life on the farm with Dean, valuing their time together away from the public eye.

Leave a Reply